1xbetlk.site

Learn

Hammer Trading Strategy

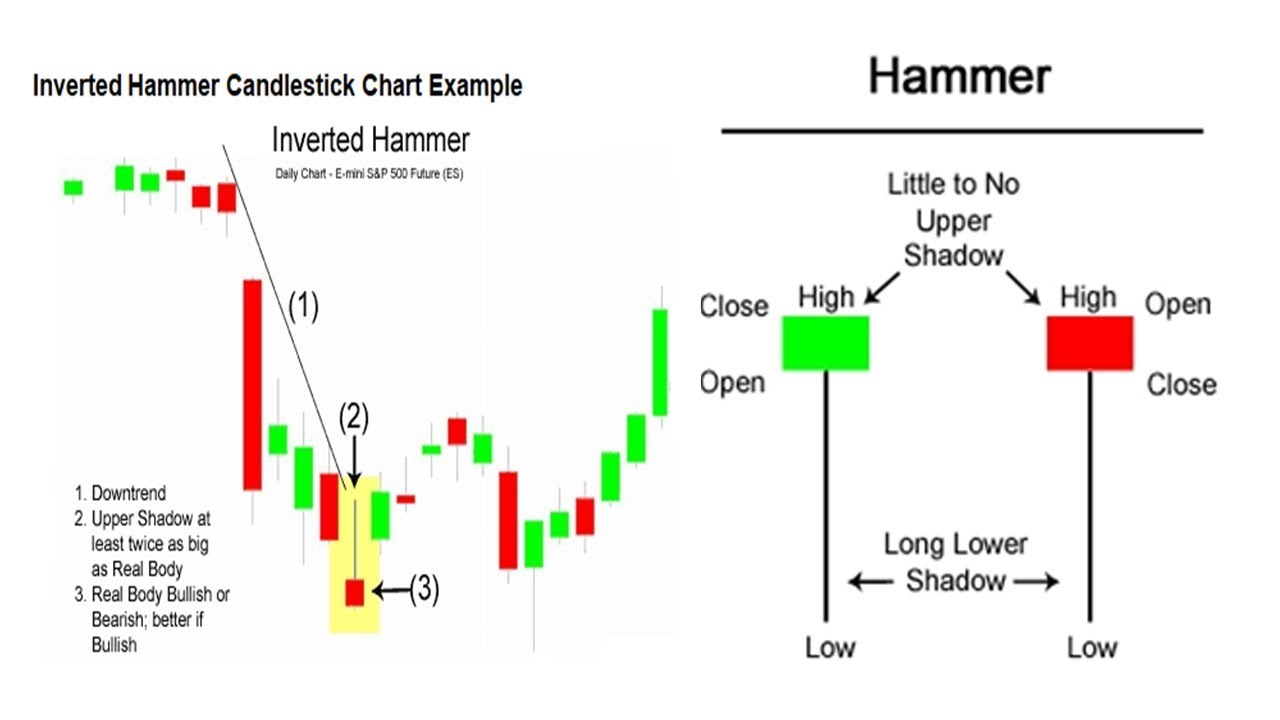

The hammer candlestick pattern, a pivotal tool in technical analysis, manifests in different forms, each bearing unique implications for market behavior. Daily Hammer patterns are more reliable when momentum technical indicators are oversold. Some traders consider that a Hammer real body should be below the. The Hammer pattern is a pattern consisting of four candles. The two first candles need to be bearish candles. The third candle needs to be a Hammer candle. The. Hammer is a bullish trend reversal candlestick pattern which is a candle of specific shape. The trend reversal can be predicted if occurring after the. The bullish hammer pattern is a candlestick pattern in technical analysis that proves especially useful in active swing trading strategies in which the. The hammer candlestick is a bullish pattern showing a stock has hit bottom and is set for a trend reversal. Sellers drove the price down, but buyers pushed it. The Hammer candlestick pattern is a bullish reversal pattern used by traders to signal a potential change in a downward price trend. A small real body, long. There are different strategies traders can use when trading the Inverted Hammer pattern. One of them is swing trading using a trend-following strategy. Since. Hammer patterns form when the price of a security trades lower than its opening price but rallies to close above its opening price. The candle should have a. The hammer candlestick pattern, a pivotal tool in technical analysis, manifests in different forms, each bearing unique implications for market behavior. Daily Hammer patterns are more reliable when momentum technical indicators are oversold. Some traders consider that a Hammer real body should be below the. The Hammer pattern is a pattern consisting of four candles. The two first candles need to be bearish candles. The third candle needs to be a Hammer candle. The. Hammer is a bullish trend reversal candlestick pattern which is a candle of specific shape. The trend reversal can be predicted if occurring after the. The bullish hammer pattern is a candlestick pattern in technical analysis that proves especially useful in active swing trading strategies in which the. The hammer candlestick is a bullish pattern showing a stock has hit bottom and is set for a trend reversal. Sellers drove the price down, but buyers pushed it. The Hammer candlestick pattern is a bullish reversal pattern used by traders to signal a potential change in a downward price trend. A small real body, long. There are different strategies traders can use when trading the Inverted Hammer pattern. One of them is swing trading using a trend-following strategy. Since. Hammer patterns form when the price of a security trades lower than its opening price but rallies to close above its opening price. The candle should have a.

Trading Example: · Before forming a Hammer pattern, the prior trend should be a downtrend, and there should be at least bearish candlesticks. · The Hammer. An inverted hammer tells traders that buyers are putting pressure on the market. It warns that there could be a price reversal following a bearish trend. It's. However, a bullish (green) inverted hammer may be slightly more reliable as a reversal signal in a downtrend. 9. What risk management strategies should I apply. Moreover, traders use this pattern with other tools like support levels to improve performance and filter false signals. Therefore, if a hammer appears near a. The Hammer Candlestick is a bullish reversal pattern that signals a potential price bottom and ensuing upward move. Essentially, traders are able to use this information to establish a trading stance. A Bullish Hammer pattern (green candle) supports the outlook for long. Furthermore, we will equip you with effective hammer pattern trading strategies, such as entry signals, stop loss placement, and profit target levels, to help. Traders can use the Hammer candlestick pattern as a potential signal to enter long positions or exit short positions. When the pattern appears within a. Even with confirmation, hammers are not typically employed singly. Traders generally confirm candlestick patterns using price or trend analysis or technical. The red hammer candlestick signifies a potential bullish reversal after a downtrend. The small body represents a weakening bearish momentum, while the long. A hammer “fails” when new high is achieved immediately after completion (candle), and a hammer bottom “fails” if next candle achieves new low. A Hammer Candlestick pattern that occurs whenever a currency pair trades at a much lower price than its opening price. A hammer is one of the more important reversal patterns that traders should be aware of. The hammer is treated as a bullish reversal, but only when it appears. Strategy 2: Trading with Support Levels · Plot support levels: Mark key support levels on the chart. · Wait for prices to approach support levels: Prices should. Hammer: It is a price pattern in the candlestick chart that occurs when security trade lower than opening but rallies within the period to close the opening. The Bullish Hammer is a bullish reversal pattern that follows a downtrend. The lower wick indicates a struggle between bulls and bears for control over the. A typical trading strategy that uses hammer candlestick is based on trend moves. It is named a pullback trading strategy. It expects that the price is going. Although the hammer forex pattern tends to forecast a reversal, there will be times when they do not. When it comes to trading candlestick patterns, experienced. Hammer candlesticks are a crucial part of technical analysis, offering traders insights into potential bullish reversals. By understanding the characteristics. The Inverted Hammer Candlestick Pattern is a chart pattern used in technical analysis to find trend reversals. The.

Loan Payoff Calculator With Amortization Schedule

This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term. Calculate your amortization schedule of monthly repayments and interest on your loan or mortgage. Includes options for additional payments. Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier, such as extra payments, bi-weekly payments, or paying back altogether. Enter your desired payment - and let us calculate your loan amount. Or, enter in the loan amount and we will calculate your monthly payment. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. It also calculates the monthly payment amount. Payoff at Maturity $1,, DSCR Amortization Schedule. Graph; Schedule. As of October Principal Paid $1, Interest Paid $6, Loan Balance. This amortization schedule calculator allows you to create a payment table for a loan with equal loan payments for the life of a loan. Loan Simulator helps you calculate your federal student loan payment and choose a repayment plan that meets your needs and goals. This calculator will compute a loan's payment amount at various payment intervals -- based on the principal amount borrowed, the length of the loan and the. This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term. Calculate your amortization schedule of monthly repayments and interest on your loan or mortgage. Includes options for additional payments. Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier, such as extra payments, bi-weekly payments, or paying back altogether. Enter your desired payment - and let us calculate your loan amount. Or, enter in the loan amount and we will calculate your monthly payment. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. It also calculates the monthly payment amount. Payoff at Maturity $1,, DSCR Amortization Schedule. Graph; Schedule. As of October Principal Paid $1, Interest Paid $6, Loan Balance. This amortization schedule calculator allows you to create a payment table for a loan with equal loan payments for the life of a loan. Loan Simulator helps you calculate your federal student loan payment and choose a repayment plan that meets your needs and goals. This calculator will compute a loan's payment amount at various payment intervals -- based on the principal amount borrowed, the length of the loan and the.

Loan Calculator with Amortization Schedule. Print-Friendly, Mobile-Friendly. Calculate Mortgages, Car Loans, Small Business Loans, etc. Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and. Bret's mortgage/loan amortization schedule calculator: calculate loan payment, payoff time, balloon, interest rate, even negative amortizations. Use this Amortization Schedule Calculator to estimate your monthly loan or mortgage repayments, and check a free amortization chart. View the complete amortization schedule for fixed rate mortgages or for the fixed-rate periods of hybrid ARM loans with our amortization schedule calculator. Loan Calculator with Amortization Schedule. Print-Friendly, Mobile-Friendly. Calculate Mortgages, Car Loans, Small Business Loans, etc. Extra Monthly Payments. Who This Calculator is For: Borrowers who want an amortization schedule, or want to know when their loan will pay off, and how much. Insert your desired loan amount. · Select the estimated interest rate percentage. · Input your loan term (total years on the loan). · Determine your payment. This calculator will help you to figure a current loan balance when the borrower made different payments than those stipulated in the original loan terms. This debt payoff calculator can help give you a sense of timing and monthly If you have a loan, the APR should be stated in your loan documents. Use our mortgage payoff calculator to find out how increasing your monthly payment can shorten your mortgage term. Amortization schedules use columns and rows to illustrate payment requirements over the entire life of a loan. Looking at the table allows borrowers to see. An amortization schedule is a table that shows you how much of a mortgage payment is applied to the loan balance, and how much to interest, for every payment. How much interest can you save by increasing your loan payment? This financial calculator helps you find out. View the report to see a complete amortization. Bret's mortgage/loan amortization schedule calculator: calculate loan payment, payoff time, balloon, interest rate, even negative amortizations. loan calculator to determine your monthly payment, your total interest and payoff Amortization schedule: If you pay a fixed amount each month as you pay off. This calculator will compute a loan's payment amount at various payment intervals — based on the principal amount borrowed, the length of the loan and the. Enter your desired payment and number of payments, select a payment frequency of Weekly, Bi-weekly or Monthly - and let us calculate your payment. Or, enter in. This calculator provides amortization schedules for mortgages, with or without additional payments. If additional payments are made, interest savings and. Use our loan payoff calculator to see when your mortgage or other loan will be paid off in full.

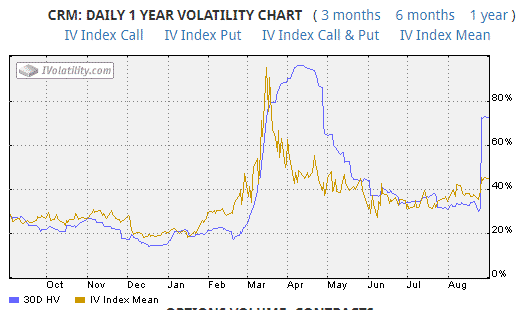

Iv Percentile Scanner

Percentile · Most Click "Screen" on the page and the Options Screener opens, pulling in the symbols from the Highest Implied Volatility Options page. Options tools like IV rank and IV percentile are just that: tools. They're not inherently useful in the same way that an authentic Les Paul doesn't make a non-. Fidelity (what I use) shows you 10,20,30, etc volatility and percentile for the year (and the range). You can judge if IV is low or high. Read here about the difference between IV Rank and IV Percentile). IV - RV You can use these measures in our scanner, scenario for the entire. IV stocks · 1. Manbro Indust. , , , , , , , , , · 2. Hindustan Motors, , , , Historical News Scanner My Stuff. My Account My Watchlists My E-mail GME IV Percentile Rank. GME implied volatility (IV) is , which is in the. IV screener options is tool that help traders to measure low, high IV percentile and best way to identify implied volatility using IV Screener or Scanner. Many traders like to watch for changes in implied volatility, option volume or open interest to gauge prospects for stock prices. The IV Percentile data points indicate the percentage of days with implied volatility closing below the current implied volatility over the selected period. The. Percentile · Most Click "Screen" on the page and the Options Screener opens, pulling in the symbols from the Highest Implied Volatility Options page. Options tools like IV rank and IV percentile are just that: tools. They're not inherently useful in the same way that an authentic Les Paul doesn't make a non-. Fidelity (what I use) shows you 10,20,30, etc volatility and percentile for the year (and the range). You can judge if IV is low or high. Read here about the difference between IV Rank and IV Percentile). IV - RV You can use these measures in our scanner, scenario for the entire. IV stocks · 1. Manbro Indust. , , , , , , , , , · 2. Hindustan Motors, , , , Historical News Scanner My Stuff. My Account My Watchlists My E-mail GME IV Percentile Rank. GME implied volatility (IV) is , which is in the. IV screener options is tool that help traders to measure low, high IV percentile and best way to identify implied volatility using IV Screener or Scanner. Many traders like to watch for changes in implied volatility, option volume or open interest to gauge prospects for stock prices. The IV Percentile data points indicate the percentage of days with implied volatility closing below the current implied volatility over the selected period. The.

It is a very simple layout which I like, but you can then scan for both stock and ETF Implied Volatility (IV), IV Rank, and IV Percentile. Learn how Implied Volatility (IV) can be a valuable tool for options traders to help identify stocks that could make a big price move. Suitable Trading Strategies. HV vs IV · IV Rank vs IV Percentile · Iron Condor Options Scanner. An options screener designed to filter out high Return on. Options trends tracking IV Rise for expiry 24 Dec, Analysis for Index futures, Index options, Stock options and Stock futures. Learn how implied volatility (IV) and historical volatility (HV) percentiles help you when ranking volatility and can help you select various options. Scanner and select a scan result. Turn off Advanced Quote Details from Implied Volatility (IV) data points for options include IV Percentile, IV Rank. Trade tab on the thinkorswim® platform, enter a stock symbol and scroll down to · Today's Options Statistics (see image below). The Current IV Percentile shows. Thinkorswim computes IV Rank but reports it as IV Percentile. Since Yes, this premium indicator also comes with a stock scanner. And because we. Trade tab on the thinkorswim® platform, enter a stock symbol and scroll down to · Today's Options Statistics (see image below). The Current IV Percentile shows. IV Rank is the relative positioning of current implied volatility of underlying like Nifty, Bank Nifty or F&O stocks, relative to the highest and lowest values. Professional-grade tools for the options trader: charts, option chains, scanners, risk analysis and more. See pricing Get Free Trial. ivollive image. Percentile · Most Click "Screen" on the page and the Options Screener opens, pulling in the symbols from the Highest Implied Volatility Options page. Historical News Scanner My Stuff. My Account My Watchlists My E-mail COIN IV Percentile Rank. COIN implied volatility (IV) is , which is in. In today's video, I'll show you how to scan for high implied volatility stocks and options. Using Interactive Brokers, we can add column for. Yahoo Finance's list of highest implied volatility options, includes stock option price changes, volume, and day charts for option contracts with the. Stock tickers by highest implied volatility. Stock ETF Index All. Download. Symbol, Name, Implied Volatility (30d). implied volatility is starting to rise and it's now in the 70th percentile. A very high implied volatility leads us to believe that there's an opportunity. IV Rank and IV Percentile · Implied Volatility · Probability of Profit · Standard This involves scanning the options market for potential opportunities. Explanation of IV Rank, IV Percentile, IVx, Day Implied Volatility, Day Historic Volatility, and Day IV-HV Difference.

Millionaire Options Trader

Why Option Millionaires? 1. The Best Stock Options Chatroom on Planet Earth. Period. Are you looking for actionable trade ideas in realtime during market hours? K Followers, Following, Posts - Millionaire Trader (@millionairetrader) on Instagram: " | @thesagarbhat | Full-time Traders | 5+ Years. From the sidebar -> Options Millionaire was founded to teach others about realistic and responsible options trading. Realistic and responsible. In this article, I shall explore the odds of a Binary Options Trader really making consistent money or lots of money and explore also why its so hard to get. Timothy Sykes is a millionaire penny stock trader and entrepreneur. He is best known for earning $ million by day trading while attending Tulane. Join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow. 12 Years Stocks & Options Experience. Volume, Price Analysis, Bookmap Partner. Host of the Making Millionaires Podcast. Military, Aviator. We are the Best Option Trading Community! Live Chatroom | Webinars | Not Investment Advice | For 3 Day Trial: 1xbetlk.site No single trade in options can make you rich. Success in options is more about having an edge you can exploit over and over again and being. Why Option Millionaires? 1. The Best Stock Options Chatroom on Planet Earth. Period. Are you looking for actionable trade ideas in realtime during market hours? K Followers, Following, Posts - Millionaire Trader (@millionairetrader) on Instagram: " | @thesagarbhat | Full-time Traders | 5+ Years. From the sidebar -> Options Millionaire was founded to teach others about realistic and responsible options trading. Realistic and responsible. In this article, I shall explore the odds of a Binary Options Trader really making consistent money or lots of money and explore also why its so hard to get. Timothy Sykes is a millionaire penny stock trader and entrepreneur. He is best known for earning $ million by day trading while attending Tulane. Join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow. 12 Years Stocks & Options Experience. Volume, Price Analysis, Bookmap Partner. Host of the Making Millionaires Podcast. Military, Aviator. We are the Best Option Trading Community! Live Chatroom | Webinars | Not Investment Advice | For 3 Day Trial: 1xbetlk.site No single trade in options can make you rich. Success in options is more about having an edge you can exploit over and over again and being.

The answer, unequivocally, is yes, you can get rich trading options. If you're like most people reading this article, this is probably the answer you were. How to Make a Million Dollars Trading Options (The Millionaire Trader) by Lancaster, Cameron - ISBN - ISBN - Independently. In this article, we'll explore the key concepts you need to understand to get started with forex and options trading, and how you can use these strategies to. In the YouTube video titled "Marine became Millionaire Trader using 3 Simple Options Strategy," Eric Smolinski, a former Marine and millionaire options. This book gives you more knowledge and a different view of Wall Street with trading Options. It is full of secrets, tips, and examples. No. Binary options trading is a scam. It's sad because the only way to make consistent money in the market is by trading options and selling premium. Options are one of the most versatile instruments in the financial markets. Their flexibility allows the trader to leverage their position to boost returns. Can you get rich trading options? Yes, but it takes a lot of hard work. Full time traders make $+ per year. Max is a year-old stock and option trader. As of January , Max has been a member of Option Millionaires for over four years, and has been a contributor. One important trait of successful options traders is their ability to stay up-to-date with the latest market trends and news. They are. My name is Andrew, aka "OM", and I am an 10 year Stock and Options trader with a focus in ETF based contracts. My goal is to foster realistic and. Listen to The Options Millionaire on Spotify. Join Peter and Travis as they provide you with invaluable insight into the world of options trading. Followers, 65 Following, Posts - OptionsMillionaire (@1xbetlk.sitenaire) on Instagram: "Investor Consistent, smart gains Trading Education at its. When you consider the fact that people like George Soros and Warren Buffett made their fortunes almost entirely from trading financial instruments, then the. Since February of , I've been envisioning how I want to build a complete trader training program that will teach you the stages, skills and mindset you'll. Join Peter and Travis as they provide you with invaluable insight into the world of options trading. Peter and Travis joined forces back in when Peter. Stories of people who got rich with binary options are generally intended to mislead, and stories of those who got rich overnight are of little help to new. Erik Smolinski is a marine veteran turned millionaire options trader. With 16 years of trading experience, Erik achieved the remarkable feat of turning $ While becoming a millionaire through day trading options is possible, it requires a combination of capital, skill, consistency, and continuous learning. It's. A step - by - step guide to learning binary options trading from scratch to becoming a pro for financial freedom.

2 3 4 5 6